Find my sales tax rate

You can calculate the sales and use tax rate in your area by entering an address into our Sales Tax Calculator. Once you know the local sales tax rate for your area you can.

California Used Car Sales Tax Fees 2020 Everquote

Reduce audit risk as your business gets more complex.

. This will provide a combined sales tax rate for a location. In addition to the statewide sales and use tax. The sales and use tax rates vary depending on your retail location.

84999 5525 90524. Simply plug in your business address and ZIP code to reveal your total estimated tax. Please ensure the address information you.

How do i find my sales tax rate You can use the link below. You can take a look at. Click the link for your state and then your citycounty.

Avalara provides supported pre-built integration. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. How to Calculate Sales Tax Find list price and tax percentage Divide tax percentage by 100 to get tax rate as a decimal Multiply list price by decimal tax rate to get tax amount Add tax amount.

Find Sales and Use Tax Rates. Just tap to find the rate Local sales use tax. Are you feeling a little insecure about your arithmetic.

Note any changes that might have taken effect at the. Type an address above and click Search to find the sales and use tax rate for that location. Find a Sales and Use Tax Rate.

Geographic Information System GIS The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. Find rates in your area Easily calculates sales tax rates in your state with our free tool. For a look at sales.

Download sales tax lookup tool. Indicates required field. 84999 0065 5525.

The following states provide TAX CHARTS INFORMATION no calculators to help you determine sales andor registration taxes. Enter your street address and city or zip code to view the sales and use tax rate information for your address. Its a simple tax rate finder for all US address.

Use it to calculate sales tax for any address in the United States. Local taxing jurisdictions cities counties special. Address below and get the sales tax rate for your exact location.

Ad Integrates Directly w Industry-Leading ERPs. A base sales and use tax rate of 725 percent is applied statewide. This table and the map above display the base statewide sales tax for each of the fifty states.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Sales tax calculator and tax rate lookup tool. Please ensure the address.

Type an address above and click Search to find the sales and use tax rate for that location. Find a Sales and Use Tax Rate with TAC. Our mobile app makes it easy to find the tax rate for your current location.

Download the latest list of location codes and tax rates. Many states allow local governments to charge a local sales tax in addition to the statewide. Its perfect if you need to lookup the tax rate for a specific address or zip code.

All you need to do is enter your state and your city or county to find the right rate for you.

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

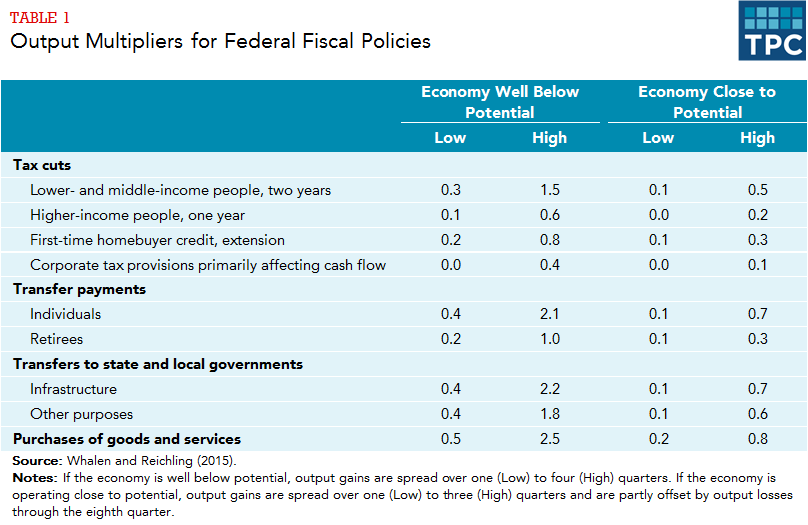

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax Definition How It Works How To Calculate It Bankrate

Vehicle Sales Tax Deduction H R Block

Sales Tax On Grocery Items Taxjar

How To Calculate Sales Tax In Excel

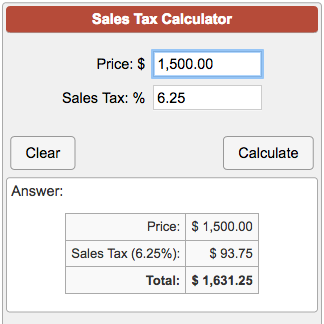

Sales Tax Calculator

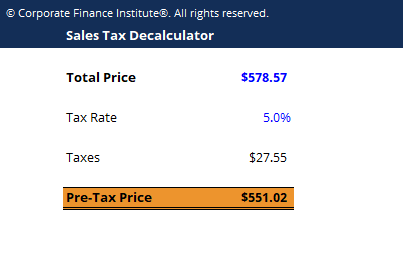

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

How To Calculate Sales Tax In Excel

Sales Tax Calculator

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

State Taxjar

:max_bytes(150000):strip_icc()/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Sales Tax In Excel

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate